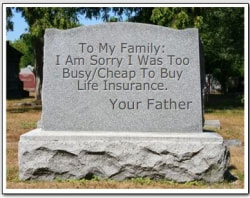

Final Expense / Burial Insurance

A traditional funeral costs about $9,000 in the US, and many people fail to plan for these costs, leaving their loved ones with an unexpected burden when they pass on. Many times it's difficult for the family to come up with these funds, unless the person planned ahead and purchased a Final Expense life insurance policy. Final Expense is a way for people to buy enough life insurance later in life to cover the costs of their burial/funeral or cremation. Some people think they are too old or in too poor of health to qualify for life insurance at that stage of life, but that's not true. If you're relatively healthy, you'll get good rates on a Final Expense policy. And even if you have a major illness such as heart disease, cancer, diabetes, etc you can still qualify for Final Expense, you just may have different terms on your plan. Sharp Insurance would be glad to show you Final Expense options from the top carriers in the nation, to ensure that your family isn't left with any unexpected burdens, and so you can feel at peace with the legacy you are leaving behind.

Click here to contact us about this product.

Click here to contact us about this product.